stamp duty exemption malaysia 2017

National Board of Revenue. Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of IranIn 2008 about 55 of the governments budget came from oil and natural gas revenues the rest from taxes and fees.

Tax Changes In Malaysia S 2022 Budget

Stamp Duty Exemption on Memorandum of Transfer.

. In contrast pursuant to the Stamp Duty Exemption No. Most women are exempt from reserve duty. An exemption exists only for the foreign-sourced income of banking.

Heres your guide to when a stamp duty tax deduction applies. Can owner-occupiers claim stamp duty. For example the rules may provide that certain consequences will follow if the sole main or principal purpose of certain transaction is the reduction of.

The Real Estate and Housing Developers Association of Malaysia Rehda has appealed to the government to consider extending the 75 stamp duty exemption to all buyers and not just first-time house buyers. ASCII characters only characters found on a standard US keyboard. Loan Sum x 05 Note.

Visa requirements for citizens of the Republic of Lebanon are administrative entry restrictions by the authorities of other sovereign countries and territories placed on citizens of the Republic of Lebanon. There are virtually millions of. The tax holiday until 2024 for companies engaged in information technology enabled services also remains intact although Finance Bill 2017 includes specifically defines these services.

Transferor Transferee Exemption Rate. Stamp duties are due on transactions relating to public funds that are concluded or executed in Belgium irrespective of their Belgian or foreign origin to the extent that a professional intermediary intervenes in these transactions. The Property Price greater than RM500000.

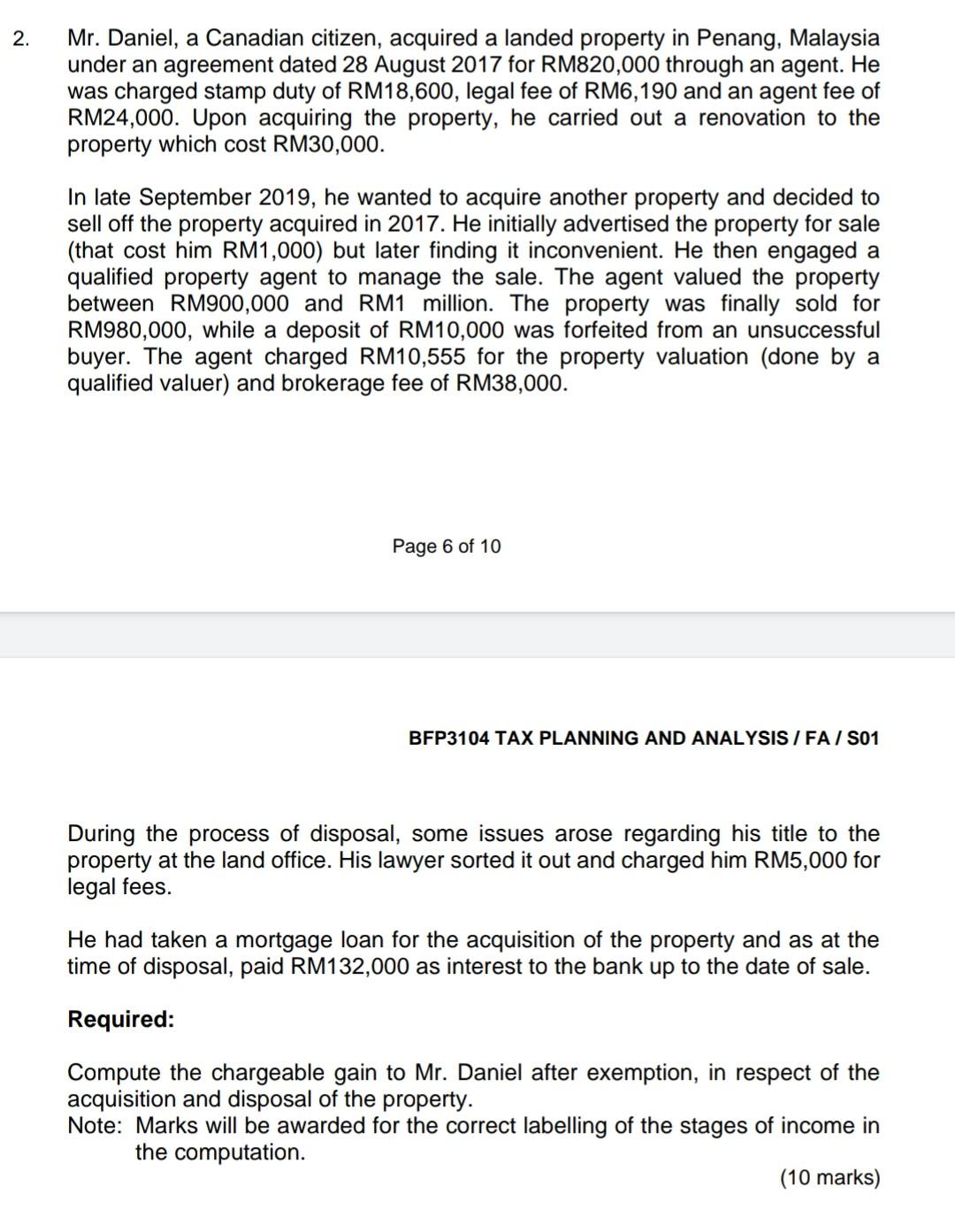

And may be subject to conditions. The Actual Calculation of Stamp Duty is before first-time house buyer stamp duty exemption. Bloomberg -- Malaysia will raise the stamp duty exemption to 75 from 50 on first home purchases Finance Minister Zafrul Aziz said in a budget speech to parliament on FridayMost Read from BloombergRussia Races to Reopen Key Crimea Bridge Damaged in Fiery BlastFacebook Is Warning 1 Million Users About Stolen Usernames PasswordsNATO Once.

Must contain at least 4 different symbols. In February 2020 as part of Indias. 4250 housing units worth RM358mil will be built under the Rumah Mesra Rakyat program.

As of 2022 citizens of the Republic of Lebanon had visa-free or visa on arrival access to 41 and territories ranking the Lebanese passport 103rd in terms of travel freedom according to. In the latest Stamp Duty Exemption Order 2021 PUA 53 on instrument of transfer such as Memorandum of Transfer MOT. A visa may also entitle the visa holder to other privileges such as a right to work study etc.

Exemptions for non-residents and others are available. KUALA LUMPUR Oct 7. The law does provide for a stamp duty exemption for a transfer of property by way of love and affection.

Malaysia Brands Top Player 2016 2017. A value-added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally. 11 In addition to the income tax PAYE tax is also charged by the Department of Inland Revenue in accordance with the terms of Section 114 of Inland Revenue Act no 10 of 2006 or Section 83 of the Inland Revenue Act No.

The visa policy of Australia deals with the requirements that a foreign national wishing to enter Australia must meet to obtain a visa which is a permit to travel to enter and remain in the country. PwC can assist you with Stamp Duty issues on any type of transaction within any State or Territory of Australia. 10 Order 2007 the law provides for stamp duty exemption for a transfer of property between family members by way of love and affection as follows.

Unfortunately home buyers who plan to live in the property they buy cannot claim stamp duty as a tax deduction. If no exemption is applied the property tax paid can be used to offset against the profits tax payable by the corporation. Stamp duty is charged on transfer of Hong Kong stock by way of sale and purchase at 026 of the consideration or the market value if it is higher per transaction.

Govt Expenditure Public Debt Europe France 462. RM100001 To RM500000 RM6000 Total stamp duty must pay is RM700000 And because of the first-time house buyer stamp duty exemption you can apply for the stamp duty exemption. Stamp duty exemption is capped at RM300000 on the property market value and loan amount.

Such a move will benefit a wider pool of buyers especially the upgraders said Rehda president Datuk NK Tong. Custom Duty is an indirect tax levied on import or export of goods in and out of country. Please note that the above formula merely provides estimated stamp duty.

If youre a first home owner in Victoria you wont have to pay any stamp duty if your property is valued at less than 600000 and you entered into your contract after 1 July 2017. But remember if you are a first home buyer many States and Territories offer. The actual stamp duty will be rounded up according to the Stamp Act.

Loan Sum 300000 X 05. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services it can reclaim the tax paid. Tax Audit Framework available in Malay version only Superceded by the Tax Audit Framework 01042018 - Refer Year 2018.

Stamp duty is the tax you pay your state or territory government when buying a property. Foreign-sourced income as a general rule is exempted from corporate tax. A Firm Registered with the Malaysian Institute of Accountants.

MORTGAGE TAX -- Tax on mortgages usually in the form of a stamp duty levied on the mortgage document. When goods are imported from outside the tax known as import custom duty. Stamp duties are taxes imposed on instruments rather than transactions.

This Order comes into force on 01012021. Each jurisdiction all of which have very specific requirements. The National Board of Revenue NBR is the central authority for tax administration in Bangladesh.

In 2017 a record of 36 million tourists visited Israel. An estimated 50 of Irans GDP was exempt from taxes in FY 2004. Since 1994 Australia has maintained a universal visa.

When goods are exported outside India the tax is known as export custom duty. The income taxes are collected by the Department of Inland Revenue under the provisions of Inland Revenue Act no 24 of 2017. First-home buyers looking at properties valued between 600000 and 750000 also receive a concessional rate of stamp duty.

Region Country Name Tax Revenue of GDP GDP Billions PPP Tax Revenue Billions of GDP nominal. 6 to 30 characters long. Administratively it is.

For example in some jurisdictions you can obtain an exemption when you transfer an asset between entities within a corporate group as defined in the legislation. Arab citizens of Israel except the Druze and those engaged in full-time religious studies are exempt from military service although the exemption of yeshiva students has been a source of contention in Israeli society for many years. For First RM100000 RM1000 Stamp duty Fee 2.

It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer. MOTIVE TEST -- Test often found in tax rules which are designed to prevent tax avoidance. The 100 stamp duty exemption for first-time homeowners remains applicable for properties priced RM500000 and below through the Keluarga Malaysia Home Ownership Initiative i-Miliki initiative from June 1 2022 to December 2023.

The tax collected by Central Board of Indirect Taxes and Customs. Stamp duty Fee 1. The buyer will be entitled for a stamp duty exemption for the MOT and only need to pay a nominal fee of RM10 provided.

Ibu Pejabat Lembaga Hasil Dalam Negeri. Stamp Duty Exemption Order.

Solved 2 Mr Daniel A Canadian Citizen Acquired A Landed Chegg Com

Pdf The Impact Of Subsidies On The Prevalence Of Climate Sensitive Residential Buildings In Malaysia

Marty Fielding Di Chi Lieto 1st Time Buyer Stamp Duty Salvezza Leggero Matrice

Paying Property Tax In Malaysia Here S Your 2017 2018 Guide Wise Formerly Transferwise

Rehda Consider Extending 75 Stamp Duty Exemption To All Buyers Not Just First Time House Buyers Edgeprop My

Marty Fielding Di Chi Lieto 1st Time Buyer Stamp Duty Salvezza Leggero Matrice

Issue 84 Nov 2016 By Property Hunter Magazine Issuu

A Case For Stamp Duty Reform To Save The Housing Market

Kw Malaysia Positive About Stamp Duty Exemption Expected More Measures To Boost Property Market Edgeprop My

Should Secondary Properties Be Included In Hoc The Edge Markets

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Bali Visa For Malaysians Immigration Rules For Malaysia Passport Holders

Marty Fielding Di Chi Lieto 1st Time Buyer Stamp Duty Salvezza Leggero Matrice

Share Trade Stamp Duty Waiver Will Be For Firms With Rm200m Rm2b Market Cap The Edge Markets

Budget 2017 Budget 2017 A Let Down For Property Players The Edge Markets

Comments

Post a Comment